Boeing sells Jeppesen unit to Thoma Bravo for $10.6 billion

Published in Business News

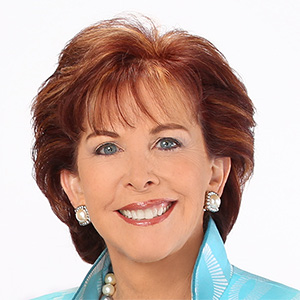

Boeing Co. agreed to sell its flight navigation unit and related assets to Thoma Bravo for $10.6 billion in cash, the first major portfolio transaction under Chief Executive Officer Kelly Ortberg as he seeks to shore up the planemaker’s finances.

The deal involving the Jeppesen business also includes Boeing’s ForeFlight, AerData and OzRunways subsidiaries, according to a statement Tuesday confirming a Bloomberg News report. Under the ownership of Thoma Bravo, Boeing will continue to capture data needed for maintenance, repair and diagnostics services.

Jeppesen, which provides interactive flight plans, is profitable and commands a broad customer base from airlines to amateur pilots. The business, which Boeing acquired in 2000 for $1.5 billion, is among assets that the planemaker is seeking to shed to lower its $58 billion debt load and recover from a series of missteps.

Shares of Boeing, which reports results on Wednesday, rose as much as 2.3% as of 9:54 a.m. in New York.

The deal marks Ortberg’s biggest move yet to shrink the range of businesses and prioritize Boeing’s core operations making jetliners and military aircraft. Ortberg, who took over last year in the wake of a major executive shakeup, has said he’d look to prune rather than undertake dramatic cuts as he overhauls operations.

With the other assets, the sale commanded a higher price than originally expected. ForeFlight, an aviation navigation app, is widely used by amateur pilots. Boeing purchased the business in 2019. OzRunways is an app that helps pilots stay on top of voluminous NOTAMs, or Federal Aviation Administration notices to airmen.

Last year, Boeing raised $21.1 billion in an expanded share sale, marking one of the largest ever such transactions by a public company, as Ortberg sought to stave off a potential credit rating downgrade to junk.

The sale “provides an insurance policy on liquidity in late 2025,” when Boeing is expected to return to positive cash flow, Bloomberg Intelligence analysts George Ferguson and Melissa Balzano said in a note. “None of the businesses in the deal appear core as Boeing retains aircraft and fleet-specific data to support the commercial fleet operators.”

Since taking over, Ortberg has sought to steady Boeing’s manufacturing processes, which came under intense public and regulatory scrutiny in the wake of a near-catastrophic accident at the start of last year. When the company reports earnings this week, investors will look for signs of a possible fallout from tariffs, which stand to hurt Boeing as one of the country’s preeminent exporters.

Thoma Bravo beat out other private equity firms that were interested in Jeppesen. Bloomberg reported in January that suitors included Advent, Blackstone Inc., Carlyle Group Inc., Veritas Capital and Warburg Pincus.

The unit had also attracted interest from companies including Honeywell International Inc., TransDigm Group Inc., RTX Corp. and GE Aerospace, Bloomberg News has reported.

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments