Philadelphia Shipyard owner Hanwha says it needs more space and workers to build US Navy vessels

Published in Business News

The U.S. government wants to build more military and cargo ships to better compete with China, and Hanwha Philly Shipyard is ready for a larger role in building those ships, Daniel O’Brien, head of Hanwha’s Washington, D.C., lobbying arm, said Wednesday on a tour of the facility his company bought for $100 million last year.

But first, the shipyard is going to need more room — and more workers, O’Brien said.

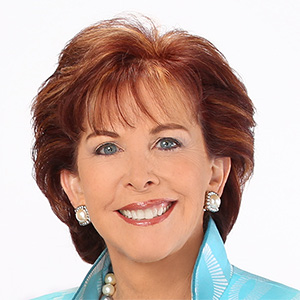

U.S. Sen. Chris Coons, D-Delaware, joined O’Brien and other Hanwha officials, along with U.S. Rep. Mary Gay Scanlon, D-Pennsylvania, and an aide to U.S. Sen. David McCormick, R-Pennsylvania, to learn more about Hanwha’s expansion plans.

Coons said he would meet next week with a top Navy operations officer to find ways to move the “mothball fleet” of old Navy ships in the basin adjoining the yard, so Hanwha can use the space for ship maintenance jobs and other work shipyard officials have said are needed to make the yard profitable.

Meanwhile, “we are looking at options across the river” in New Jersey to acquire former industrial sites that might be converted to shipbuilding and support work, O’Brien said. The New Jersey bank of the Delaware River is lined with active and closed-down energy, chemical, and manufacturing facilities that could support shipbuilding.

Hanwha is also in talks about the future of some of the former Navy dry docks adjoining its property, which were formerly operated by Philadelphia Shipbuilding Co. That company stopped operations last year after completing maintenance work on the Battleship New Jersey, now a tourist attraction in Camden.

Hiring hundreds

As of last year, the yard employed around 1,800 people, around two-thirds of whom were contract employees. Many are from outside the region, due to a shortage of maritime welders and other skilled labor.

Hanwha plans to hire another 100 staff this year and 240 next year to handle new work and replace veterans nearing retirement age.

The company has 160 apprentice trainees in eight-week courses as marine welders, shipbuilders, and ship outfitters. It plans additional classes for machine operators, said Megan Heileman, a Detroit native who trained as a schoolteacher but is now an instructor for Hanwha.

Heileman said that’s the largest apprentice class since the yard reopened its training programs in 2021.

She said candidates have been referred by state and county agencies. Some formerly worked in construction, others in offices. One ran a daycare center; another was a Wawa manager. Some have come from other parts of the country, attracted by rising pay and the prospect of steady hours.

Brendan Donohoe, a Philadelphia native, moved home to join the apprentice training program, leaving his job at an Indiana automotive factory after a supervisor told him the Philadelphia yard was hiring.

He’s training as a marine welder. The eight-week course follows eight previous weeks he and other prospective apprentices worked as helpers in the yard to acclimate them to work conditions there.

Donohoe said he was attracted by the wages — $22.60 an hour to start and raises every six months during the three-year apprenticeship to the maximum scale of $38 an hour. Union leaders say they expect base pay will top $40 an hour in future contracts.

Joseph Zanolli said he was a pipe fitter for a nonunion construction company in Montgomery County before joining the apprenticeship program. He was attracted not only by the wages but also by the prospect of regular overtime.

“It seems like more steady work, with less possibility of layoffs,” he said.

Jeneece Zlomek, a Baltimore native who lives in Philadelphia, is training as a welder. She used to be a hairstylist. Nobody in her family worked on ships, but an uncle was an Air Force mechanic. “My dad said, ‘You’re gonna go from using razors to using welding guns,’ ” she said, smiling.

Global competition

China is by far the largest shipbuilding nation, with South Korea, including the giant Hanwha (formerly Daewoo) yard in Ulsan, a distant second.

Shipbuilders need patient, wealthy investors. With private investment funds focused on faster, higher returns from digital and biotech projects, shipyards rely on government contracts and subsidies. Without competing offers, Hanwha was able to purchase the Philadelphia yard last year for $100 million, a fraction of the value of the total subsidies the federal and state government had poured in over nearly 30 years.

Coons noted that China has been sending ships and planes over international waters close to U.S. allies such as the Philippines and Taiwan. That has been fueling calls from both parties for the U.S. to build more seagoing drones and other warcraft to counter the China threat.

Under its previous controlling owner, Norway-based Aker, the Philadelphia yard, after a difficult period won a string of contracts for training ships and commercial freight carriers and has since 2020 become the busiest of the handful of working shipyards in the U.S.

The Trump administration, besides boosting taxes on Chinese export ships, is also trying to force shippers to rely more on commercial ships built in U.S. yards. The U.S. Trade Representatives Office last week proposed a domestic-content rule for ships that export U.S. liquefied natural gas that could send new LNG tanker work to the Philadelphia yard.

The yard is part of the former Philadelphia Naval Base. Besides the shipyard, the sprawling site is now a suburban-style office campus that is home to the Urban Outfitters retail store chains, WuXi AppTec cell and gene therapy production centers, GlaxoSmithKline investment offices — and U.S. Navy engineering offices, the property’s largest single employer.

Plans call for adding housing and other amenities — mostly in the central and eastern parts of the former base, far from the junction of the Schuylkill and the Delaware River, where the main shipyard facilities are.

There are also plans to expand the civilian port facilities operated by Holt Logistics Corp. on the Delaware River north of the old base.

©2025 The Philadelphia Inquirer, LLC. Visit at inquirer.com. Distributed by Tribune Content Agency, LLC.

Comments