Consumers have been worried about the economy for years. Now they're acting like it

Published in Business News

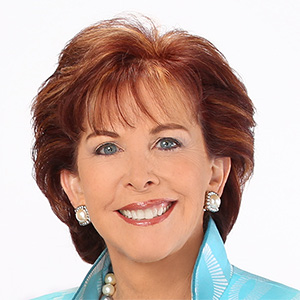

Natalie Slinger’s growing family could use a bigger house and a second car. Right now, both feel out of reach.

Slinger and her husband already have one child in day care, which costs as much as their mortgage. They rarely eat out and limit their travel to camping. Their second child, due this fall, will rely on hand-me-downs.

“The cost of things is very omnipresent for us,” said Slinger, 29, of St. Paul, Minnesota.

Today, consumers are not just saying they’re worried about the economy — they’re acting like it. From slowing auto sales to declines in leisure air travel, consumer spending barely budged in June, rising just 0.3% after staying flat in May.

American consumers are pulling back on spending as the effects of tariffs — like the slowing job market and rising inflation — begin to show. It’s a shift from a few years ago, when higher inflation sparked consumer concern but a strong labor market, government stimulus and pent-up pandemic demand kept people spending.

“When there are big changes in the economy, you generally see consumer sentiment and spending move together,” said Nancy Vanden Houten, lead U.S. economist at Oxford Economics.

On Friday, a weaker-than-expected July jobs report showed the U.S. added about 73,000 jobs last month and about 100,000 over the past three — growth “that is not consistent with a growing workforce,” said David Royal, chief financial and investment officer at Thrivent.

The report, which included big downward revisions to the May and June jobs numbers, prompted President Donald Trump to claim without evidence that the report was “rigged” and fire the commissioner of the Bureau of Labor Statistics, the independent agency that produces data the public and private sectors rely on.

Meanwhile, prices are ticking up. The personal consumption expenditures (PCE) index, the Federal Reserve’s preferred inflation measure, rose 2.6% in June compared with the same period last year.

“There are definitely signs of vulnerability,” said Joanne Hsu, director of the University of Michigan’s Surveys of Consumers, a widely influential gauge of how American consumers view the economy.

Sentiment rose slightly in June and July, but remains largely negative, according to a Friday release. Consumers expect labor market conditions to worsen, Hsu said, and their income expectations “are anemic.”

“I think that’s really the main thing that explains why we’re starting to see a pullback in the spending response,” she said.

Consumer sentiment hit an all-time low in June 2022, with people across income levels agreeing “that things were looking really bad,” Hsu said. Inflation reached a 40-year high of more than 9% that month.

But higher-income consumers’ mood quickly improved — and they kept spending — until last April. That’s when overall sentiment tanked again after the White House announced tariffs on countries across the world and most goods.

The tariff rate for most countries is now lower than initially proposed, though Trump announced a slate of new import taxes last week. Already this week, the president has threatened to “substantially” raise import taxes on goods from India.

Tariff impacts have taken time to show up in the data, in part because they’ve been implemented later or at different rates than first announced, Oxford Economics’ Vanden Houten said.

The forecasting firm is projecting the average tariff rate on U.S. imports will land at around 20% — up from 2% at the beginning of the year — and the consumer price index inflation measure will peak at 3.5% in the fourth quarter, she said.

“Things are unfolding more slowly,” Vanden Houten said, “but I don’t think that we should assume that, ‘OK, this is not going to be so bad.’”

For now, Slinger and her husband are following the news and planning accordingly, from buying needed furniture before tariffs took effect to keeping an eye on what federal budget cuts might mean for their jobs at the University of Minnesota.

And lately, he’s been reading travel guides as they dream about a trip to Australia.

“We know we want to go there,” Slinger said, “but we have no idea when we will ever go to Australia.”

©2025 The Minnesota Star Tribune. Visit at startribune.com. Distributed by Tribune Content Agency, LLC.

Comments