Adding children to the title of your home usually has tax consequences

Q: My daughter’s name was added to the title to her mother’s home so that she could inherit the house tax free. Her mom has now died and my daughter is selling the home. What are the tax consequences?

A: This is our least favorite way for parents to pass on ownership. When you add a child’s name to the title, you’re essentially gifting half the property to that person. That move will typically have tax consequences, where if the child inherited the property, she would receive the stepped-up basis and be able to sell the property tax free.

To illustrate, let’s assume your daughter became an equal owner of the home when her mom put her on title with her. At that time, she likely became a 50% owner of the home with her mom. She took ownership of the home at whatever her 50% was worth at that time.

Let’s say your daughter’s mom purchased the home for $100,000. And let’s also assume at the time your daughter became a co-owner of the home, the home was worth $200,000. When her mom died, the home was worth $250,000 and we assume that your daughter sold the home for that price around the time of her mom’s death or within a year of her death.

In these situations, it’s helpful to split the home into two transactions to understand the tax consequences: the mom’s side of the sale and your daughter’s side. From your daughter’s vantage point, your daughter took ownership of the home when her half interest was worth $100,000 and now her half interest is worth $125,000. Using these numbers and without any closing costs or fees, she’d show a $25,000 profit on the sale of the home.

On the other hand, your daughter would have inherited her mom’s share of the home at its value at the time of her death. In this instance, your daughter would have inherited her share at a value of $125,000. Given that your daughter inherited her share of the home for $125,000 and that share was sold for $125,000, your daughter would show no profit on the sale of the home.

Generally, the smarter way, from a tax perspective, is to allow your children (or other heirs) to inherit your property, especially if the heirs pay none of the expenses and take none of the tax benefits of homeownership. The heirs will inherit the home at the current market value as of the date of death. In our example, her daughter would have inherited the home at a value of $250,000 and then sold the home at that same value so she would pay no taxes to the federal government on the sale of the home.

Once you put a child on the title to the home, the child becomes an owner at that moment in time, and it seems troubling to later claim that they only became an owner of the home when the parent died. For this reason, we never advise parents to put their children on the title of their home.

If you’re trying to bypass probate or make the transfer of property easier for the estate, the parent can record a transfer on death deed (TOD) that would give the child ownership of the home when they die. Or, the parent can put the home into a trust naming the child as the beneficiary of the trust. Either of these methods would allow the child to get the benefit of the stepped-up basis of the home and would make the transfer process easier and less expensive.

For example, let’s assume the mom had purchased the home for $100,000, but at the time of her death the home was worth $1,000,000. That would represent a huge increase in the value of the home. Upon her death, the daughter could inherit the home at its current market value either by the transfer on death deed, via a trust document or through probate.

If she turns around and sells the home for $1,000,000, the daughter would pay no federal income taxes on that sale. Because she received the stepped-up basis on the home, she’d effectively sell the home for the same price as the inherited price so she’d have no federal taxes to pay.

However, if she had co-owned the home with her mom, she would only receive the stepped-up basis on her mother’s share of the home. If she then sells the property for the same $1 million, she would likely owe taxes on her 50% share of the net profit, or $450,000.

How much tax would she owe? On her share, she’d likely pay capital gains taxes at a maximum rate of 20% plus the 3.8% investment income tax that is referred to as the Net Investment Income Tax. So, that means she’d pay around 23.8% tax on the profits from her sale of her half of the home.

The best thing your daughter can do now is talk with a local Enrolled Agent, a tax account, an estate attorney or a tax attorney about how the sale of the property will affect her. She might also want to download IRS Publication 523 — Selling Your Home — from irs.gov.

========

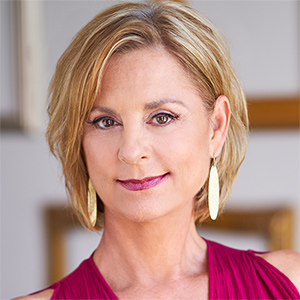

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask (4th Edition).” She writes the Love, Money + Real Estate Newsletter, available at Glink.Substack.com. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments