Jim Rossman: A little planning will make things easier after you’re gone

Published in Science & Technology News

If your family is like mine, one person is likely in charge of doing the finances and paying the bills and because so much of our financial dealings happen online, that task will usually fall to one person.

If you happen to be that person for your family, have you thought about what kind of information your family would need to move forward if something were to suddenly happen to you?

If you got hit by a bus tomorrow, would the bills get paid? Would your family know how to access your bank accounts, insurance or even your retirement accounts?

I’m sure you’re doing a good job keeping your finances in shape, but if you were gone, can your family even get into your phone or computer? Could they log into your email account?

Years ago, when I traveled a lot for work, I realized so much of our finances happened online that it would not be very easy for my wife to figure it all out without specific instructions – so I created a document called “the bill situation.”

I wanted my wife to have a list of all our monthly bills, the account numbers, website addresses and login information for each site, and to know how each of those bills got paid.

All of our monthly bills get paid automatically, and I wanted her to know how to see all that for herself.

I didn’t stop there.

The list grew to include our insurance information for both health insurance and car/home insurance along with how those get paid.

Then I covered the banking situation and listed our checking and savings accounts, including how to access them online.

I also included how to access our retirement accounts, including the login for the website and phone numbers for our financial adviser.

When I was compiling this list, I took the time to log into each website and make sure the password still worked. I also verified beneficiary information on the appropriate accounts.

I listed accounts like our streaming TV services and our cell phones as well as credit cards, including balance information and how the payments for all those accounts were set up.

Don’t forget about legal documents like car titles and mortgage documents.

This isn’t rocket science. Most of us could get this information together in a day or two.

If you’re needing a reminder, take a look back through a few months’ checking account transactions to see what is getting paid each month.

You should keep this information in a place that will be easy for your family to access, which might be a safe deposit box or secure place in your home.

This is your most important and sensitive personal information, and you want to do everything you can to keep it safe, while making sure those who need it can get to it when the time comes.

If you aren’t married, you might want to provide this type of information for your children or the executor of your estate. Leaving a copy of the file with your lawyer/estate planner is not a bad idea if you don’t have family close by.

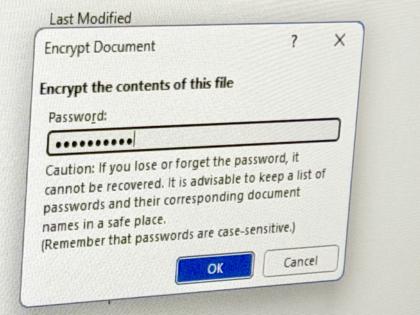

If you elect to keep this information electronically, please consider carefully where you’ll store it and make sure it is somewhere that’s password protected.

My wife reminded me recently that I should revisit and update our information, and that’s now at the top of my list.

©2026 Tribune Content Agency, LLC.

Comments