Editorial: The economy is flashing red for many American consumers

Published in Op Eds

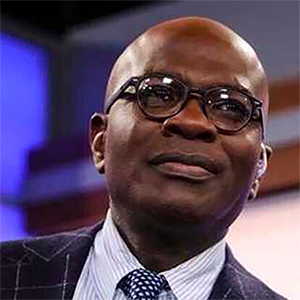

Take it from a guy who made more than $30 million last year: Low-income consumers are “living on the edge.”

So says Charlie Scharf, chief executive of the Wells Fargo bank, citing data that indicate most American consumers are spending down their ready cash. For many, the rainy day they’ve been dreading has arrived.

A recent survey shows the share of consumers living paycheck to paycheck rose sharply this summer, and just 25% of U.S. adults say they are better off financially than a year ago. Credit scores continue to fall.

The financial markets have remained resilient. But investors are stockpiling gold and favoring defensive stocks that do well in hard times, even as they bet on a huge payoff from artificial intelligence that may not materialize anytime soon.

The labor market is especially troubling. Americans are staying unemployed for longer, and the jobless rate is on the rise for bellwether groups like young adults and minorities that typically lead the way into downturns. Job creation has been stagnant for a while, with revised jobs numbers showing the U.S. added 911,000 fewer jobs for the 12 months ending March than initially reported, according to the Bureau of Labor Statistics. Wage gains have stalled.

The U.S. economy isn’t in recession, but lower-income households are under increasing strain. Fed policy, weak job creation and President Donald Trump’s tariffs are making things worse, especially for budget-conscious families. Consumers need to brace themselves.

In announcing its first interest-rate cut since December, the U.S. Federal Reserve on Wednesday indicated the risk of higher unemployment outweighs concerns about rising inflation. It’s pick-your-poison time for the Fed, which is supposed to aim for both full employment and keeping prices in check. By making economic growth its priority, the Fed is courting inflation, which is projected to clock in around 3% at year-end, well above the agency’s 2% target.

Uncertainty about tariffs has led many companies to put the brakes on hiring, weakening the labor market. How can bosses bring on new workers when all they know for sure is that costs are soaring? Similarly, consumers worried about inflation are making purchases now to lock in prices they expect to go up. That can put prices on an upward spiral, and tariffs are making things worse.

Consider the end of “de minimis” rule that exempted shipments under $800 from tariffs and other duties. Starting at the end of August, low-value goods shipped from overseas are being slapped with new fees that raise their costs. Knowing the tax was coming, consumers ramped up their online spending, which helped to keep retail sales going and cushion the broader impact of rising prices — temporarily.

Those low-value shipments were helping many U.S. consumers make ends meet. An astonishing 1.4 billion packages came into the country under the rule during 2024, more than double the level of 2020, with a typical shipment averaging less than $50.

Most people using the de minimis exception were on a budget and sensitive to prices, according to research from Yale University and the University of California, Los Angeles. Ending the rule disproportionately hurts low-income and minority households, which also bear the brunt of the labor-market slowdown.

Not everyone’s doing badly, though. Companies far removed from the world of private jets and Rolex watches increasingly cater to high-income consumers like Wells Fargo’s Charlie Scharf, as middle-class purchasing power erodes.

It’s no accident that Walmart is pushing Apple tech gear while McDonald’s is crowing to Wall Street about the wealthy offsetting a decline in spending from its traditional customer base. High earners and many older Americans continue to prosper.

For the rest, now is the time to prepare for a sluggish job market and higher prices by taking steps that are easy to say, but hard to do: Pay down high-interest debt and avoid taking on new debt. Establish an emergency fund. Consider starting a side hustle like freelance work or a part-time job for supplemental income.

Unless you’re a Charlie Scharf, now’s the time to be realistic, pragmatic and well-prepared. Your budget will thank you for it in the future.

___

©2025 Chicago Tribune. Visit at chicagotribune.com. Distributed by Tribune Content Agency, LLC.

Comments