House panel will take up GOP bill to curb members' stock trading

Published in Political News

WASHINGTON — After months of pressure from rank-and-file members, a House panel will consider a new Republican-led bill this week that aims to prohibit members of Congress from trading stocks.

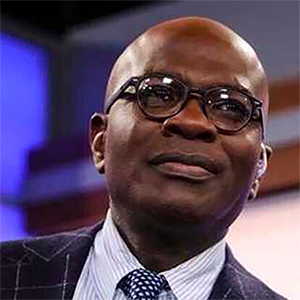

The bill, unveiled Monday by House Administration Chair Bryan Steil, R-Wis., would ban members of Congress, their spouses and dependent children from buying new stocks. But it would allow them to keep the ones they already own, and they could still buy and sell diversified investment funds.

If members wanted to sell their individual stocks, they would be required to publicly give notice at least seven days and no more than 14 days before doing so.

The House Administration Committee will mark up the bill on Wednesday, alongside another measure that would withhold pay from members of Congress during a government shutdown.

The stock bill has the blessing of Republican leadership and is co-sponsored by GOP members of the House Administration panel, in addition to Reps. Anna Paulina Luna, R-Fla., Chip Roy, R-Texas, Mike Lawler, R-N.Y., and Michael Cloud, R-Texas.

Majority Leader Steve Scalise, R-La., said in a statement he “would like to move this bill for a full House vote soon after it gets out of committee.”

Banning members of Congress from trading stocks has become a thorny issue over the past several months, with more than 25 bills introduced in the 119th Congress related to the issue.

A 2012 law, known as the STOCK Act, already bars members from trading on inside information. But the law is rarely enforced and lawmakers regularly sidestep its reporting requirements.

Frustrated by what they said was a lack of progress, a bipartisan working group drafted consensus legislation they dubbed the Restore Trust in Congress Act, which was introduced in September. That bill, led by Roy and Rep. Seth Magaziner, D-R.I., would ban members not only from trading individual stocks, but also from owning them. And unlike many other proposals, it would not allow blind trusts.

Steil’s bill, meanwhile, includes an exception for “investments held in a trust if no covered individual has any authority over a trustee of the trust, including the authority to appoint, replace, or direct the actions of such a trustee, and the trustee is not the spouse, child, parent, or sibling of a member of Congress.”

While Steil’s bill does not go as far as the consensus bill, Luna characterized it as a “step in the right direction.”

“This is a win, but it should be noted that this would not have happened if individual members, both Democrats and Republicans, had not stepped forward to call this out on both sides,” she posted on X on Monday.

Luna had filed a discharge petition on the Roy-Magaziner measure that aimed to override leadership and force a vote on the floor, with members of both parties signing on. But the bipartisan momentum started to crumble in late December, as Democratic leaders said they would prefer a stock-trading ban that included not only members of Congress, but also the president and vice president.

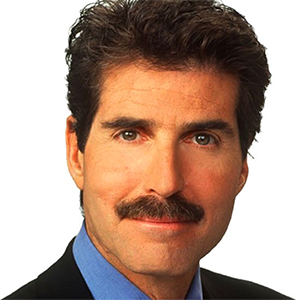

“There is absolutely no justification for the president ... or the vice president to be able to trade stocks in real time, when they have more access to inside information than perhaps the entire United States Congress combined,” Minority Leader Hakeem Jeffries, D-N.Y., said at a December press briefing.

Including the executive branch is a nonstarter for Republicans who fear angering President Donald Trump.

Supporters of Steil’s bill said that even without disallowing stock ownership entirely, it would help improve Congress’ image and implement guardrails that have broad support from voters. They also point to penalties they say give it teeth.

Violators would face fines equal to the sum of either $2,000 or 10% of the value of the transaction in the covered investment, whichever is greater, and the net gain realized from the sale.

“No member of Congress should be allowed to profit from insider information, and this legislation represents an important step in our efforts to restore the people’s faith and trust in Congress,” Speaker Mike Johnson, R-La., said in a statement Monday. “Both Republicans and Democrats will have an opportunity to make their voices heard and affirm their support.”

The vote could put some lawmakers in an uncomfortable position, as Democrats decide whether to hold out for deeper changes backed by their leadership. Meanwhile, not everyone wants to give up stock trading in the first place.

“This legislation is critical to restoring the public’s trust in their elected officials. If you want to trade stocks, go to Wall Street, not Capitol Hill,” Steil said.

©2026 CQ-Roll Call, Inc., All Rights Reserved. Visit cqrollcall.com. Distributed by Tribune Content Agency, LLC.

Comments