Ford's 'refined' EV plans seek Model e profitability: Here's how

Published in Business News

Ford Motor Co.'s Model e electric vehicle division has lost billions of dollars for years, but executives say it'll exit the red by 2029.

Expensive batteries and capital investments for new plants have challenged margins for the division. Unlocking its value is a key part of the company's goal of achieving an 8% adjusted operating margin by 2029, up from 3.6% in 2025. The Dearborn, Michigan, automaker now says it can produce higher-margin products with cheaper and fewer batteries, partnerships and a more efficient platform.

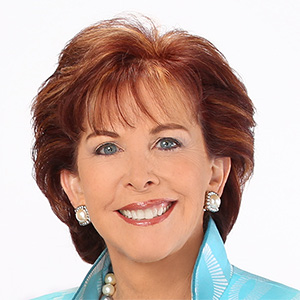

"We dealt decisively with the reality of the market," Ford CEO Jim Farley said last week on an earnings call, "and shifted our focus of our EV business to a high-volume, affordable end of the market."

Pullbacks in federal support for EVs and regulatory cuts to fuel economy and carbon emissions standards have alleviated strain on automakers to push plug-in vehicles on consumers who are showing by their buying decisions they still want V-8s, off-road gas guzzlers and affordable models that they easily can fuel up. But Chinese brands are expanding globally with subsidized, low-cost EVs that are eating up market share in other countries, and Ford executives believe they need to compete with them to survive long-term.

"It’s hard to predict the next year, let alone 2029," said Daniel Ives, analyst at investment firm Wedbush Securities Inc. "They have to lay out a strategy and stick to it. It's a black cloud over their story. Some of those factors are out of their control relative to EV tax credits. At least it sets a target that investors are now focused on."

The Blue Oval's second-generation EVs have already begun to be launched in Europe and represent larger margins than earlier models. A higher mix of those vehicles over EVs in the United States contributed to Model e losses last year falling by about $300 million to $4.8 billion.

They're expected to decline this year, too, with the automaker forecasting results to finish between $4 billion and $4.5 billion in an adjusted operating loss. This reflects about $1.6 billion in improvement in first-generation products, driven by lower U.S. volume made possible by regulatory rollbacks and cost savings from restructuring the business, Chief Financial Officer Sherry House said, though part of that is offset by $600 million in costs preparing to launch next-generation EVs and their batteries. Across the company, Ford is planning $1 billion in material and warranty cost reductions, including on its EVs.

But analysts like Garrett Nelson at financial data company CFRA Research say they're "skeptical" Ford will achieve its Model e loss reduction and break even by 2029.

"They don't have the products in the pipeline," Nelson said. "They're just not investing in the business that would drive increased volume and improve financials of the business. They're doing the right thing in that they don't want to abandon EVs. The new EV platforms are going to help on margin, but they need new models to drive EV sales growth."

A quarter of capital expenditures will be devoted to Model e, including Ford Energy and products, House said. Ford expects this year to spend $9.5 billion to $10.5 billion in capital expenditures.

The second-generation EVs in the United States will be built off the automaker's Universal EV Platform, the first of which — a midsize truck starting at $30,000 — launches next year at Louisville Assembly Plant in Kentucky. Ford hasn't said how many vehicles it will produce off the UEV platform, but that there will be multiple top hats.

The truck will be one of five vehicles by the end of the decade that Ford will launch starting at under $40,000, up from two currently with the Bronco Sport and Maverick small pickup. The company in December said it will launch a new "affordable" gas truck and commercial van with gas and hybrid models in 2029.

The UEV platform and a new production system behind it that replaces the century-old moving assembly line pioneered by Henry Ford removes 20% of parts in efforts to reduce costs, improve quality and increase production speed.

"Tesla has shown that we can make money in that market," Farley said about affordable EVs, "without subsidy from the government at the right cost level."

Texas-based Tesla Inc. reported a net income of $3.794 billion last year, though it was down 47% from 2024 amid increasing competition globally from Chinese brands and political backlash. Ford's net loss last year was $8.2 billion because of one-time special charges related to its EV restructuring plans. Without those, Ford's adjusted operating profit was $6.8 billion, and it's guiding for growth to $8 billion to $10 billion in 2026.

Ford's hands-off Level 2+ autonomous driving technology will also launch on UEV products. Level 3, which will allow drivers to take their eyes off the road, will follow in 2028. That and other software will contribute to Model e's results.

Ford's UEV products will use lithium-iron-phosphate batteries that Ford will build at its BlueOval Battery Park Michigan site in the state's south-central Marshall. Licensed technology from China's Contemporary Amperex Technology Co. Ltd., the batteries use less-expensive materials than nickel-manganese-cobalt batteries traditionally found in EVs.

Versions of the Mustang Mach-E SUV already contain LFP batteries. The LFP batteries, though, are less energy-dense than NMC systems, which means more battery cells are needed to travel an equivalent distance.

By focusing on smaller vehicles, however, Ford expects it can produce a profitable product with fewer batteries, which represent a large chunk of an EV's cost. It's canceled plans for electric three-row SUVs, next-gen full-size trucks and commercial vans that would require too many batteries to offer sufficient range for consumers to be profitable.

"I wouldn't characterize it as a kind of gross change in the EV strategy," House said this week at the Wolfe Research Auto, Auto Tech and Semiconductor Conference. "I would say what we've done is we've refined it."

In Europe, Ford is a leader in light commercial vehicles, but House said a passenger vehicle business is also necessary to maintain a robust dealer network. Ford is sharing costs on EVs through an existing partnership with Volkswagen AG and a new agreement with Renault SA. The French rival is supplying an EV platform for two small, B-segment passenger vehicles. Developing with partners vehicles that are smaller — as preferred by consumers in that contracting market but not by most American car buyers — can alleviate strain on resources. The first launch under the agreement is expected in 2028.

"We see that as a very critical moment for us," Farley said.

Ford has also conversations with Volvo parent Zhejiang Geely Holding Group Co. Ltd. over utilizing open capacity at its European plants.

Income generated by Ford Energy and extended-range electric vehicles also will contribute to Model e's results, Ford spokesperson Dave Tovar confirmed. The Ford Energy subsidiary will build stationary energy storage systems for data centers, utilities and other industrial applications at the former BlueOvalSK Battery Park in Glendale, Kentucky, that Ford is retaining following the dissolution of its joint venture with South Korean battery partner SK On Ltd. The business expects to deploy at least 20 gigawatt-hours annually by late 2027.

"You start to really see that benefit in '28 and '29," House said. "We think we're at the right place, at the right time, with the right tech."

The BlueOval Battery Park in Marshall, Michigan, will also produce smaller Amp-hour cells for use in residential energy storage solutions.

The discontinued F-150 Lightning pickup truck will return in its second-generation as an extended-range electric vehicle. Often likened to hybrids, which fall under the Ford Blue division with internal combustion engine vehicles, EREVs differ in that the vehicle operates fully off a battery, but has an engine on board that works as a generator to charge the battery. This allows for a smaller battery in the vehicle than a fully electric model and alleviates range anxiety for customers.

Towing needs make EREV the best solution for the truck, given the limitations of plug-in hybrids and fully electric vehicles, Farley said.

Also key to achieving Ford's 8% margin, House said, will be cost reductions, quality improvements, unlocking greater profits from software features and services and other higher-margin products.

©2026 www.detroitnews.com. Visit at detroitnews.com. Distributed by Tribune Content Agency, LLC.

Comments