Homeowner wants more control over saving for real estate taxes, insurance premiums

Q: We currently have an impound account for our home, which includes both property taxes and homeowner insurance. Because of the increases with both of these, every year our monthly payment goes up.

We would like to have more control over our monthly payment and would prefer to keep it the same throughout the remaining life of the loan. We are OK with setting aside money for the property taxes and insurance on our own. Can we make this change without refinancing our mortgage and are there any penalties for doing so?

A: These are great questions, especially now that there has been so much news about rising insurance costs.

Your question deals with the amount of money a mortgage lender collects from borrowers on a monthly basis so that the lender can pay real estate tax and insurance bills when they come due. Sometimes the amounts collected are called tax and insurance escrows. In other cases, they’re referred to as tax and insurance impounds. Regardless, the money goes into an account that the lender uses to pay those real estate taxes and insurance bills.

While you’re upset your monthly cost goes up each year, your insurance premiums are also increasing. The lender will have to charge you more to cover higher premiums. In some parts of the country, premiums have doubled or tripled. If the premiums go up but the lender doesn’t increase the amount you pay, they won’t have enough cash in your account to pay those bills. The same thing is true with real estate taxes. Every year, those bills rise too. So, the lender has to collect more money.

Here’s how lenders calculate the escrow or impound account amounts. They take the most recent real estate tax and insurance bill amounts, divide by 12, and then add up to two months’ cushion. The law allows lenders to keep that cushion just in case the next bill increases by more than expected.

Lenders need to be able to pay these bills, because the home is the collateral for your mortgage. If the home burns down, the lender may lose some, most or all of their collateral should they need to foreclose on the home. When it comes to real estate taxes, these are a lien on a home by the local government that usually takes priority over the mortgage lender. Again, the lender doesn’t want anything to come between their collateral and their ability to get the full benefit of the value of the home.

So, for most borrowers, lenders will collect money for the payment of real estate taxes and homeowners insurance premiums.

You want to avoid having to make those payments to the lender. Well, in some situations, you can ask your lender to waive the requirement of having an escrow for real estate taxes and insurance. However, most lenders won’t allow that unless the loan amount or the balance due on the loan is low.

For example, let’s say your home is worth $250,000 and you have a loan balance of $100,000. The lender may be willing to waive the escrow or impound account and allow you to pay your own real estate tax and insurance bills. Contact your lender, ask them for an escrow waiver and take it from there. They may be willing to waive the escrow given that you — the homeowner — has more to lose if taxes or insurance bills don’t get paid.

Beware, however, that some lenders charge a fee to waive escrow or impound accounts. Sometimes, this fee is so high it doesn’t make sense for you to pay it just to have the privilege of paying your own real estate taxes and insurance premiums.

========

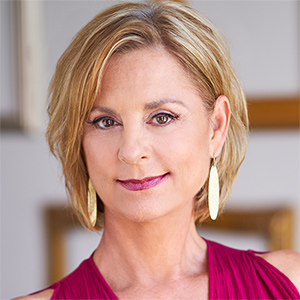

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments