Who pays bills on reverse mortgage after homeowners pass away?

Q: Our mother and father took out a reverse mortgage years ago. There is no equity in the property. Our mother died several years ago and our father passed away recently. We contacted the company that administers the reverse mortgage about processing a deed in lieu of foreclosure on their home. We sent them all the required information and the letter of intent.

Their instructions state they would place the property in custodial care once they have received confirmation that the property is vacant and cleared of personal property. We sent that confirmation to them several months ago.

We now have several questions. Since they told us they will place the condo in custodial care, are we still responsible for paying property insurance on the condo?

It has been over three months since we submitted all the information to them and we have yet to hear from them. We received emails stating that they received our submissions, but nothing since. I’ve called several times and was told that someone would call me back, but I've never received a call. Are you aware of how long this process typically takes?

A: Dealing with loan servicers and other banking institutions can sometimes feel like falling into a big black hole. Or, watching paint dry. We have to answer your question by going back to the basics of how reverse mortgages work.

The reverse mortgage lender your parents applied to gave your parents a sum of money years ago based on the interest rate at the time, the value of the home and the amount of equity. Your parents never paid anything on this debt, although they had to pay property taxes.

The way a reverse mortgage works is when the last of the owners of the home dies or stops using the home as their principal residence, the loan comes due. Either they or their heirs (if the homeowners have passed), can sell the home to satisfy the debt owed the lender. Or, if you stop making payments, the lender would foreclose, sell the home and satisfy the debt with the money received from the home sale.

It doesn’t always balance out, by the way. Sometimes the house is worth more than what is owed to the lender, in which case the heirs (or owner) would get something back. But, lenders often lose money if the home is worth less when sold than the debt owed.

You’ve done the right thing in contacting the loan servicer to let them know your parents have passed. Until the loan servicer actually takes title to the home, the home is still in your parents name — that is to say, still part of your parents’ estate. You’re wondering who should pick up the real estate tax bills and insurance premiums. In a condo situation, we wonder whether you should also pay the monthly assessments.

Usually a reverse mortgage lender in a reverse mortgage would expect the borrower (or heirs) to pay the real estate tax and insurance bills until title changes. The property is still in your parents’ name until the lender takes title to it. If something happens to the condo, their estate could be sued for damages. From that perspective, we suggest you continue to pay those insurance premiums. Likewise, if you don’t pay the assessments owed, the association can sue your parents’ estate for the money they would owe the association. When it comes to real estate taxes, those will accrue and continue to be owed whether you pay them or the lender pays them down the line.

We’re wondering why you haven’t tried to sell the condo. If you simply listed the condo and then sold it, you could use the proceeds from the sale to pay off the reverse mortgage and any other closing expenses.

Also, if there is money left after paying the lender and closing costs, that money would be for you and other family members. We understand that in some cases, the amount owed to the reverse mortgage lender is far above the value of the condo. You can call the lender and get an estimated amount you’d need to clear the debt. Then, talk to some local real estate agents about what the condo is worth. If the debt is higher, you could simply try to give the condo to the lender using a deed in lieu of foreclosure.

The lender would rather have the debt paid than take title to the home. If your situation is such that the loan value far exceeds the value of the condo, it’s probably not worth spending money to pay these bills. You’d just want to do the deed in lieu of foreclosure. Having said that, we’d urge you to talk to an attorney and go over these issues further.

Finally, given that the home is in your parents’ estate, the person handling the estate has an obligation to settle the debts of their estate. We don’t know what assets they had when they died or what other debts they had, but they do have this reverse mortgage. So, talk to an estate attorney to figure out your obligations to continue to pay the money owed on the condo every month, including utilities, assessments, taxes, insurance and any other miscellaneous expenses.

========

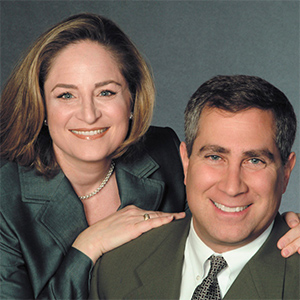

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments